The Of Fortitude Financial Group

The Of Fortitude Financial Group

Blog Article

Not known Facts About Fortitude Financial Group

Table of ContentsOur Fortitude Financial Group StatementsThe Facts About Fortitude Financial Group Revealed8 Simple Techniques For Fortitude Financial GroupWhat Does Fortitude Financial Group Do?Our Fortitude Financial Group Diaries

Essentially, a monetary advisor helps people manage their money. Usually, there is an investing component to their solutions, yet not always. Some financial consultants, often accounting professionals or attorneys who concentrate on depends on and estates, are riches managers. One of their main functions is protecting customer wealth from the IRS.Normally, their focus is on informing customers and giving danger monitoring, cash money circulation evaluation, retirement preparation, education planning, spending and a lot more. Unlike attorneys who have to go to regulation institution and pass the bar or medical professionals that have to go to medical school and pass their boards, financial advisors have no specific unique demands.

If it's not with an academic program, it's from apprenticing at a financial advising company. As noted previously, though, many consultants come from various other areas.

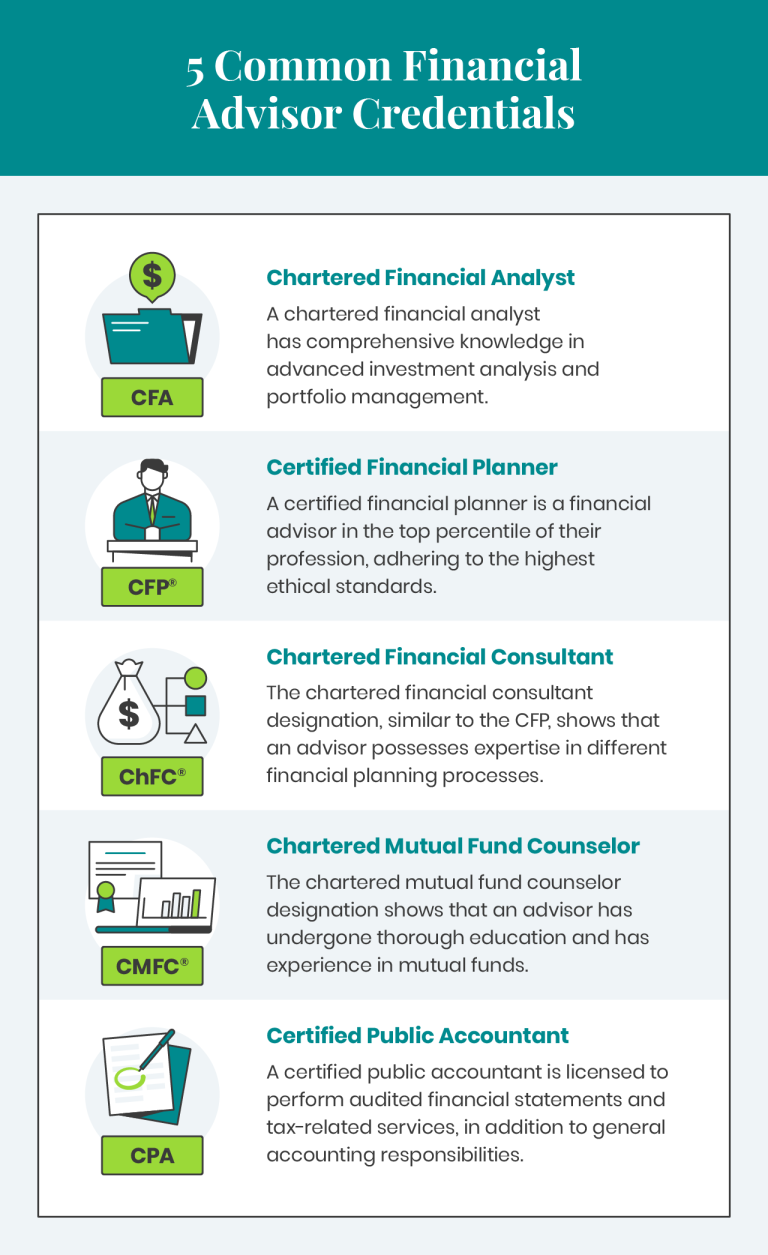

Or maybe a person who handles properties for an investment business determines they would certainly rather help individuals and work on the retail side of the business. Several financial consultants, whether they already have expert degrees or not, experience accreditation programs for even more training. A general financial consultant qualification is the qualified monetary organizer (CFP), while a sophisticated variation is the legal financial professional (ChFC).

Everything about Fortitude Financial Group

Generally, a financial consultant uses financial investment management, financial planning or riches monitoring. Investment management includes designing your financial investment approach, executing it, monitoring your portfolio and rebalancing it when required. This can be on an optional basis, which means the advisor has the authority to make trades without your authorization. Or it can be done on a non-discretionary basis by which you'll have to accept individual trades and choices.

It will certainly detail a series of steps to require to achieve your financial goals, including an investment strategy that you can implement by yourself or if you desire the advisor's help, you can either employ them to do it as soon as or sign up for ongoing administration. St. Petersburg, FL, Financial Advising Service. Or if you have particular needs, you can work with the expert for financial preparation on a project basis

Their names often say all of it: Securities licenses, on the various other hand, are a lot more regarding the sales side of investing. Financial advisors who are likewise brokers or insurance agents often tend to have securities licenses. If they directly get or market supplies, bonds, insurance coverage products or provide financial advice, they'll need particular licenses associated with those items.

One of the most preferred safeties sales licenses include Series 6 and Series 7 designations (https://www.quora.com/profile/Cheryl-Lee-Morales). A Series 6 permit permits a financial expert to offer investment items such as shared funds, variable annuities, device investment trusts (UITs) and some insurance coverage items. The Collection 7 permit, or General Stocks permit (GS), enables a consultant to sell most kinds of securities, like typical and participating preferred stocks, bonds, alternatives, packaged investment items and important site even more.

Our Fortitude Financial Group Statements

Constantly make certain to inquire about monetary consultants' fee timetables. To find this information on your own, visit the company's Kind ADV that it files with the SEC.Generally talking, there are two kinds of pay structures: fee-only and fee-based. A fee-only consultant's single type of compensation is via client-paid fees.

, it's crucial to know there are a variety of compensation techniques they may utilize. (AUM) for handling your cash.

Based upon the aforementioned Advisory HQ research study, rates typically range from $120 to $300 per hour, frequently with a cap to just how much you'll pay in total. Financial advisors can make money with a taken care of fee-for-service model. If you desire a standard monetary plan, you may pay a level fee to obtain one, with the Advisory HQ study showing average prices varying from $7,500 to $55,000, relying on your possession tier.

About Fortitude Financial Group

When a consultant, such as a broker-dealer, markets you a monetary item, he or she obtains a particular percent of the sale amount. Some monetary professionals that function for huge broker agent companies, such as Charles Schwab or Integrity, obtain a wage from their company.

Report this page